Yesterday, I briefly discussed one way to save money – stay out of the store.

Today, I’d like to share how I organize my finances and how my system helps me save money.

Ordinarily, I am a pen and paper girl by heart. I like to feel and manipulate paper in my hands. I love writing with cool gel pens. I am a paper junkie. However, about a year and a half ago, I ‘met’ Grandpa Terry. Grandpa Terry is not my real grandfather, nor have I really met the man – but he has helped me tremendously these past few months.

You see, Grandpa Terry runs Budget Stretcher, a personal money management website. Here, you can find tons of free resources to help you manage your money. I found his site accidentally (imagine that) when I went Googling printable budget forms. Before leaving his site, I made sure to sign up for his newsletter. It was free and it was loaded with tons of great information.

I was happy. I was content.

After awhile, however, I learned about GT’s Budget Stretcher Premium newsletter and all the free programs that came with membership. This is where I learned about the Bill Pay System. This is when things really started to click for me.

You see, I’m always online.

- I bank online.

- I shop online.

- I will soon be going to school online.

- I track the kids’ school lunch funds online.

- I communicate with friends and long-distance family online.

Everything I do is either online or on the computer.

So, it would only stand to reason that I take my I-Love-Paper Geek self and jump head first into the 21st Century and computer banking. Enter The Bill Pay System.

TBPS is an excel file – just a simple ol’ excel file that acts as checkbook register. I like it because it does my math for me. (I have a tendency of transposing numbers).

I simply put in a beginning balance and away I go! I can even date the register (Jan-Mar, Jan 1, 2009, or January). This way, if there is a discrepancy with my online banking, I can go right back to my excel file, open up whichever month I want to look at and go right to the entry.

Of course, one must remember to enter all of her checks, debit purchases and ATM withdraws; but really, this is no different than putting it into your old fashioned checkbook register. It’s just a matter of doing it.

Knowing exactly how much money I have saves me from overdraft fees – did you know the average overdraft fee is $27? My bank charges $25 – money that can be spent elsewhere, for sure!

Knowing exactly how much money I have gives me peace of mind, too. It’s a little hard to explain. I’ve never been to Vegas and I’ve never gambled, but to spend without knowing how much money you have left is a little bit like playing Russian Roulette (which I also haven’t done). It’s nerve-wracking and stress-inducing. Not to mention so unnecessary.

Now, at this point, you might think all of this advice is a big, fat ‘duh’. Well, I would agree – now. But there was a time when I didn’t do any of what I’m telling you and I know I’m not alone. I know of women who never balance their checkbooks – or even manage any part of the household money! This article is for those of you who want to take control back, but aren’t quite sure how to do it.

Having a balanced checkbook was only half of my battle. Paying overdue/late fees due to late payments were killing me. I even got a few shut off notices (to date, my phone has been shut off twice; not because I didn’t have the money – but because I wasn’t organized to pay the bill on time). Hey, guys…I’m not making this up! Reading this, I want to shake my head in my ignorance. But hopefully, by opening myself up, sharing what I’ve gone through and what I’ve learned, I can help someone. Or heck, you can even help me. I don’t have it all together. I’m always learning.

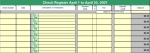

The great thing about Grandpa’s Terry Bill Pay System is that not only does it come with a checkbook register, it also comes with a bill ledger:

This is really cool! With this ledger (also an excel file – in the same program!) you can keep track of all of your bills: when they’re due, how much is due, which paycheck you’ll use to pay them, and how you paid them (cash, check, auto draft, etc). Not only that – but this ledger keeps track of your bills for three months at a time!

Down here in GA, our summers get hot (and start about mid April). Using GT’s BPS bill ledger, I can keep track of my summer electric bills for say May, June and July to help me budget for next summer. The bill ledger also helps see where your money is going so if you need to tweak your budget, you can.

There are tons of ways to balance your checkbook and keep track of your bills. I urge you to use whatever works for you. Please, just use something! Its been my experience that most of these ‘too much month at the end of the money’ can be avoided by careful planning. The first step of planning is seeing where you are. These tools are a great place to start.

All images are property of Terry Rigg. All rights reserved.